FAFSA 101

The Free Application for Federal Student Aid (FAFSA) is the most important step in knowing your options for paying for college. There’s no obligation to accept any aid offered, and it allows you to be considered for federal, state and college-based funding – including scholarships and grants that don’t need to be repaid.

4 out of 5 college students receive some combination of federal, state, and college-based aid to go to college. The FAFSA is the most important step to accessing these funds.

What is the FAFSA?

The FAFSA is the form students need to fill out in order to be considered for federal financial aid each year to help make paying for college more manageable.

What are the benefits to filling out the FAFSA?

In addition to being considered for federal financial aid like the Pell grant:

- North Carolina uses the FAFSA to determine eligibility for state aid as well

- Most colleges use information in the FAFSA to award college-based aid too.

- You are not required to accept all aid offered to you. Completing the FAFSA gives you information about the financial aid you qualify for so you know your options.

- You are also not obligated to enroll in college by filling out the FAFSA.

- In most cases, it’s worth the time it takes to fill out the form to find out your options for financial aid.

Who can fill out the FAFSA?

Students who are U.S. citizens or eligible non-citizens can fill out the FAFSA.

How do I fill out the FAFSA?

The FAFSA is available in an online version and a paper version, though you are encouraged to use the online form because it reduces the number of questions you will need to answer by pulling information from your account and the IRS that also reduces errors.

Where does my information go?

After you fill out the FAFSA, the information you share will go to the colleges you include in your form so that they can determine your eligibility for state scholarships, including either the Next NC Scholarship or the NC Need-based Scholarship, and prepare financial aid offers for you to consider.

You could be eligible for the Next NC Scholarship. Click here to find out more.

You could be eligible for a NC Need-based Scholarship. Click here to find out more.

The first step to filling out the FAFSA is to set up an account at StudentAid.gov. You will need to enter your name and Social Security Number (SSN) exactly as it appears on your SSN card.

- ProTip: Double check to make sure you entered your information correctly, as typing errors are the most common mistakes students make.

It can take 1-3 business days for your account to be verified and ready to use, so be sure to set up your account at least a few days before you are ready to fill out your FAFSA.

Contributors – You may need others to contribute to your FAFSA:

- Dependent students: If you are a dependent student, you will need to include financial information from one or more of your parents/legal guardian, so they will need to set up an account as well. To determine which parent/legal guardian needs to contribute to your FAFSA, use this online tool.

- Independent students: If you are married, your spouse will need to contribute their financial information to your FAFSA.

Each contributor will need their own StudentAid.gov, because the account is used to verify each person’s identity in order to import federal tax information into your FAFSA, helping to save time and avoid errors. Each contributor will need a personal email address associated with their account so you can continue to be notified even after the school year is over.

- ProTip: FSA recommends for parents, guardians or spouses who are contributors to your FAFSA to take a picture of their account creation page to share with you so that when you invite them to contribute to your FAFSA, you can enter their information correctly. This will save time linking their account to your FAFSA.

Save your account set up information so that you have your username and password, as well as the phone number, email address and authenticator app you used to set up 2-step verification when you log into your account.

- ProTip: Make sure to note the backup code you are assigned when your account is set up. This will help you get into your account if your other 2-step verification methods fail.

If you need help setting up your account, the Federal Student Aid administration has helpful videos that walk you through the process.

If you have a parent who does not have an SSN, they can still set up a StudentAid.gov account. They can simply check the box “I do not have a Social Security number”. They will be asked to verify their identity through a series of questions from TransUnion.

Once your account has been verified, (typically in 1-3 business days) you can complete your FAFSA if it is after October 1st. Here is what you will need to fill out the form:

- SSN (if you have one)

- Tax return for you and your contributors (parents or spouse)

- Child support (if applicable)

- Savings, checking, investments, and other account balances. Note: Home value and retirement-specific account balances do not need to be included.

- Estimated value of a family business or farm

- Email address for each contributor associated with their StudentAid.gov account

Each contributor fills out the information for their section of the FAFSA. Typically, you, as the student, would enter your information first, and then invite your contributors (parents or spouse, where applicable) to complete their section. However, it is possible for the parent/legal guardian to enter their information first.

- ProTip: It is easiest to fill out the form if you and your parent(s) or spouse are together when filling out the form.

Federal tax information will be imported directly from your IRS tax return and that of your contributors in the online form. This will reduce the chance of errors and save you time, since you don’t have to enter the information manually. You will be required to provide your consent to have your information shared with your FAFSA.

- Important: If you or a contributor declines to consent to having information imported from the IRS, you will not be considered for federal or state financial aid.

Help available. Throughout the form, help text is available to assist with answering the form correctly for your situation. If you need additional help:

- Check the FAFSA Help webpage for answers to frequently asked questions.

- Use the chat feature in the online form.

- Contact the Federal Student Aid Information Center: Call 1-800-433-3243

- ProTip: The best days to call for help are Tuesday and Wednesday, when staffing levels are highest.

- Contact the financial aid office at the college nearest you to get your questions answered. You do not need to attend that college to get help.

If you have a parent that does not have an SSN, the SSN will be blank and disabled. If your parent has an Individual Taxpayer Identification Number (ITIN), they should add it to your FAFSA form in the ITIN field only. By doing so, the FAFSA will import their tax information directly from the IRS after they consent. If they don’t have an ITIN, they should leave it blank, but they will have to manually enter their tax information.

Share your FAFSA information with the colleges of your choice. You can request to have your FAFSA information shared with up to 20 colleges during or after submission. The colleges will use your information to determine financial need in order to prepare a financial aid offer to attend that college. Once you select the college you wish to attend, you will need to accept the aid you wish to take advantage of to help make paying for college more manageable.

- ProTip: You do not have to accept all aid offered. If, for instance, you don’t want to accept student loans, you can decline that portion of your award offer while accepting grants and scholarships.

Student Aid Index (SAI): The information you entered will be used to create a SAI, which the colleges will use to estimate financial need in putting together your financial aid award offer. Some colleges have aid to offer even if you’re not eligible for aid from the federal government.

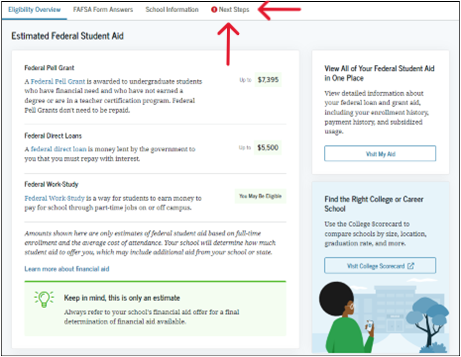

Review your FAFSA Submission Summary (FSS). It typically takes about 1-3 days to process your FAFSA. When you log into your StudentAid.gov account you will see the estimated federal aid you likely qualify for, along with your SAI. You should review your answers to confirm the information you entered is correct. Finally, on the “Next Steps” tab you can see any additional steps you need to take, such as correcting errors or providing additional information to your college(s) of choice, often to verify the information you entered.

- Important: If your FSS includes next steps, your FAFSA is not yet being considered for financial aid. Complete the steps indicated so that the colleges you are interested in can provide you with a financial aid offer.

Verification. Some FAFSAs get flagged for verification. Don’t worry, you didn’t do anything wrong! The college financial aid office simply needs to verify some information on your FSS.

Financial aid award offers. Be on the lookout for financial aid award offers in your email or mail from the colleges you indicated on your FAFSA. You can use these award offers to compare how much it will cost to attend each of the colleges you are interested in. These offers will include all the aid you qualify for from the federal and state government, as well as the college itself. Compare these offers to the total cost of attendance for each college, and consider how much you also have to contribute to your college education.

Once you have selected a college, you will need to review the various types of aid that have been offered to you. You are not required to accept any type of aid you don’t want to accept.

- Grants and scholarships. Gift aid doesn’t have to be paid back.

- Work study. Work study allows you to get a part-time job, often on campus, that allows you to earn money while you go to college.

- Student loans. If you are offered student loans, you are not required to accept them, as they will need to be paid back. If you do decide to accept a student loan, only take what you need, when you need it.

Apply for scholarships. Is there still a gap between cost of attendance, financial aid, and your family funds? Apply for additional scholarships. Check out CFNC’s scholarship portal to find scholarships for North Carolina students.

Have your circumstances changed since you completed your FAFSA? If your circumstances have changed, such as the death of a parent or the loss of a job, contact your financial aid office. They may be able to adjust your financial aid award.

You will need to complete the FAFSA each year you are attending college. For a small investment in time you gain access to financial aid at the federal, state, and college level.